Hot Upcoming IPOs to Watch

The most exciting upcoming IPOs include buy now, pay later firm Klarna and online banking firm Chime.

The initial public offering (IPO) market started to pick up the pace late in the first quarter, but concerns about the economic impact of the Trump administration's tariffs have some companies pressing the pause button amid broader market uncertainty.

According to Renaissance Capital, a leading provider of pre-IPO research and IPO-focused ETFs, there have been 80 IPOs priced so far in 2025, through May 27, up 38% year over year.

Of those offerings, a total of $11.8 billion in proceeds was raised, a 17% decrease over the year-ago period.

In addition to the uncertainty surrounding tariffs, a sell-off in tech stocks and increasing market volatility have made pricing new offerings a major challenge.

"There was a pretty clear shift in IPO sentiment after the tariff announcements, which introduced a lot of uncertainty into the market," says Avery Marquez, director of investment strategies at Renaissance Capital.

"Volatility can be a strong headwind for new issuance, even when investor sentiment and risk appetite are robust. But this came while the trading environment was already somewhat weak in the wake of the mid-Q1 sell-off," Marquez adds.

Beyond tariffs, macroeconomic pressures – including inflation, higher interest rates and geopolitical instability – have spooked investors.

There are some signs that activity in the IPO market is recommencing. Trading platform eToro (ETOR), for one, saw strong demand in its mid-May trading debut.

And Hinge Health, a digital health care startup, raised $437 million in its offering.

Upcoming IPOs

More companies appear to be testing the waters, too, making now the best time to explore the most anticipated upcoming IPOs.

For those looking to gain exposure to these new stocks, it's imperative to have an understanding of what an IPO is before jumping in.

Having covered the most promising upcoming IPOs for Kiplinger for several years, I've crafted this latest list to spotlight larger, well-established companies that are sure to gain the attention of both Wall Street and Main Street.

Data is as of May 27. Where possible, we have provided reported expectations for timelines and/or valuations for the upcoming IPOs.

Company | Industry | Expected IPO timeline |

|---|---|---|

Klarna | E-commerce | 2025 |

Chime | Fintech | June 2025 |

StubHub | Entertainment | 2025 |

Databricks | Computer software | 2026 |

AppsFlyer | Mobile attribution and analytics | 2026 |

Solera | Automotive software | 2025 |

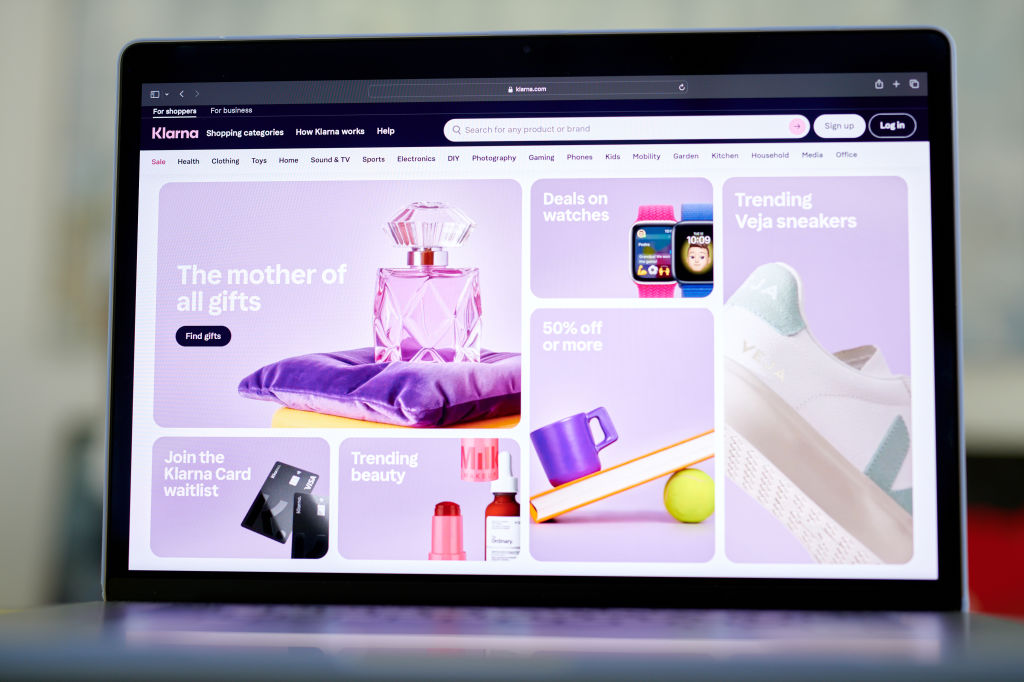

Klarna

In 2005, Sebastian Siemiatkowski, Niklas Adalberth and Victor Jacobsson co-founded Klarna, which is based in Sweden. They wanted to disrupt the online payments market, which was complicated and expensive. Their concept was to allow for "buy now, pay later" spending.

Generating interest from investors was a big challenge, but the co-founders weren't deterred. They were convinced they were pursuing a massive business opportunity.

Klarna would be a catalyst for fueling e-commerce, providing guarantees to buyers and allowing them to try something before making a purchase. This was critical for engendering trust.

Today, Klarna is a massive business, with 93 million active consumers and 675,000 merchants. At the end of 2024, it had $105 billion in gross merchandise volume, $2.8 billion in revenue and $21 million in net profit.

Klarna has also invested significantly in generative AI to streamline its operations, partnering with OpenAI to build a sophisticated chatbot for customer support.

During its first month of implementation, Klarna's chatbot handled the work of about 700 full-time agents — with roughly the same level of customer satisfaction and improved accuracy. Klarna forecast its chatbot will lead to an improvement of $40 million in profits.

In March, Klarna filed its IPO prospectus, signaling its intention to trade on the New York Stock Exchange under the ticker symbol "KLAR."

However, due to the tariff-inspired stock market volatility, Klarna has reportedly paused its IPO plans.

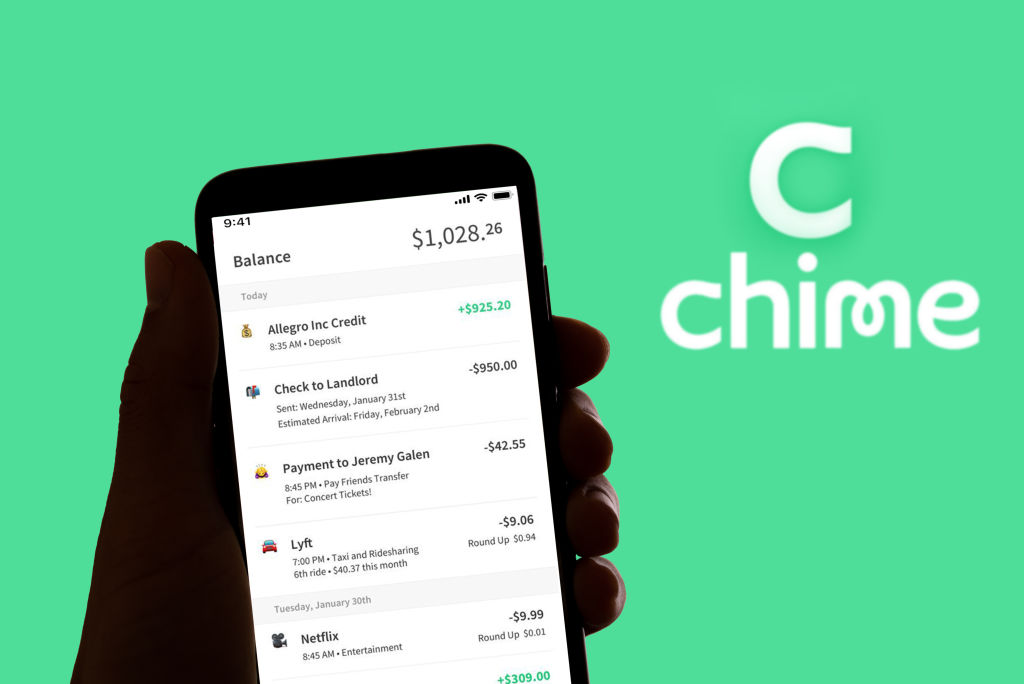

Chime

Back In 2012, Chris Britt and Ryan King aimed to disrupt the traditional banking industry. It was too expensive, and it failed to serve younger and lower-income people.

Britt and King co-founded Chime, a mobile-first banking app. Their goal was to reduce and even eliminate fees for things such as minimum balances and overdrafts.

Chime also offered competitive interest rates on deposit balances as well as credit cards, and it introduced a feature to allow customers to get paid between paydays.

The formula has paid off. Chime has become the largest digital-only bank, now generating about $1.8 billion in revenue with about 8.6 million members, according to Renaissance Capital.

Chime is also leveraging its platform into other market opportunities, illustrated by its recent acquisition of Salt Labs. Salt Labs develops enterprise software to allow companies to provide rewards programs to employees. This will open a new revenue stream for the company and establish more distribution channels for the Chime app.

Chime has been investing heavily in AI, as well. It recently entered a partnership with FairPlay, a platform for risk management.

In May, the company filed its IPO paperwork with the Securities and Exchange Commission (SEC). Chime is expected to begin trading on the Nasdaq under the ticker symbol "CHYM" in early June.

StubHub

At the peak of the dot-com bubble in 2000, Eric Baker co-founded the ticket resale platform StubHub. The business was controversial at the time, as it was widely construed simply as scalping. Yet, StubHub would gain lots of traction.

A major step for management was the formation of partnerships with professional baseball, basketball and football teams. Baker left StubHub a few years later due to disagreements with his co-founder.

In 2007, eBay (EBAY) bought StubHub for $300 million. Baker was gone, but his involvement with StubHub never really ended. He launched Viagogo Entertainment, a ticketing firm focused on the European market. In 2020, Viagogo bought StubHub from eBay for $4.05 billion.

The next step? Baker plans to take StubHub public. The company filed its paperwork on March 21, with plans to trade on the New York Stock Exchange under the ticker symbol "STUB."

According to its filing, StubHub has operations in more than 90 countries and sells more than 40 million tickets annually. In 2024, it had $8.7 billion in gross merchandise sales, up 27% over 2023.

Similar to Klarna, StubHub is delaying its IPO due to market volatility. The company is now expected to go public in late summer or early fall of this year.

Databricks

Many companies are still struggling to get their data house in order. It's all over the place. Different teams using different systems, formats that don't match, files with missing information, or duplicated rows that throw everything off.

Fixing this isn't just tedious; it's a serious obstacle for anyone trying to use AI effectively.

That's the pain point Databricks was built around.

The story starts back in 2009, at UC Berkeley's AMPLab. Matei Zaharia, then a Ph.D. student, came up with Apache Spark, a faster, more flexible way to process big data, especially compared to older tools like MapReduce.

Spark could handle large jobs in memory, making things such as streaming and machine learning more efficient.

A few years later, Zaharia joined up with some fellow researchers, including Ali Ghodsi and Ion Stoica. In 2013, they launched Databricks to bring Spark into the hands of enterprises. The company's platform made it easier to analyze large-scale data in the cloud.

One big innovation: Databricks introduced what it calls a "lakehouse" architecture. It's a hybrid model that merges the strengths of data lakes and warehouses, so users can manage raw and structured data in the same place, without jumping between tools.

Today, Databricks is powering data and AI efforts at over 10,000 organizations, including Comcast (CMCSA), Shell (SHEL) and Rivian (RIVN).

The company's growth hasn't gone unnoticed. In early 2025, Databricks pulled in a $10 billion funding round. That pushed its valuation to $62 billion. The company also secured a $5.25 billion line of credit.

So, why is Databricks eyeing an IPO?

There are a couple of good reasons. Going public adds transparency, which tends to matter for big enterprise customers.

But perhaps more important is having a publicly traded stock that makes acquisitions easier. And that's something Databricks is already doing at a steady clip. Recent deals include generative AI customization platform MosaicML and Neon, a serverless database platform.

While Databricks has not yet filed paperwork for a public offering, Ghodsi said in January that it would not be "a huge surprise to me if we were public" by early 2026, according to CNBC.

AppsFlyer

For mobile marketers, understanding what's working – and what's not – has never been simple. Traditional web tools often miss the mark in mobile environments, where user behavior spans apps, platforms and privacy restrictions.

That's the gap AppsFlyer set out to fill. Founded in 2011 by Israeli entrepreneurs Oren Kaniel and Reshef Mann, AppsFlyer built a name for itself by solving one of digital marketing's trickiest challenges: attribution.

In plain terms, it helps brands figure out where their app users are coming from and which campaigns are driving real engagement.

AppsFlyer's platform connects the dots across mobile devices, in-app activity, and ad networks. Its attribution tools are integrated with more than 5,000 marketing partners, from giants like Google and Meta to niche platforms.

That level of visibility allows companies to make smarter decisions about where to spend marketing dollars. And in an era when privacy rules are tightening, AppsFlyer has doubled down on solutions that give clients useful data while staying compliant with global regulations.

By 2020, the company had raised $210 million in Series D funding led by General Atlantic, joining the unicorn ranks with a valuation north of $1.6 billion. Other backers have included Goldman Sachs Growth Equity and Eight Roads Ventures.

As for an upcoming IPO, the company is working with Goldman Sachs, JPMorgan Chase, and Bank of America, according to Bloomberg. A listing could raise around $300 million.

Solera

In early 2005, business executive Tony Aquila founded Solera to develop software for risk management of the automotive industry. It didn't take him long to gain the interest of investors. A year later, he announced a $100 million funding round from GTCR, a private equity firm.

At the heart of the strategy were aggressive acquisitions, notably, Solera's purchase of the Claims Services Group from ADP for $975 million.

By 2007, Solera had launched an IPO, providing more resources for management's dealmaking. In 2015, Solera went private in a $6.5 billion transaction.

Fast-forward to today: Solera has completed more than 50 acquisitions and built an extensive platform for the purchase, underwriting and claims-processing for insurance, as well as the management of repairs, services, maintenance, fleet operations and valuations.

Solera has also established critical partnerships with 20 primary property and casualty insurance carriers, 130,000 repair shops and nine of the top 10 U.S. dealership groups.

The company's vast datasets create a key competitive advantage for Solera, enabling the construction of sophisticated AI models for improving claims management as well as vehicle repairs.

As for the financials, Solera generates hefty cash flow. For fiscal 2024, that figure was $1 billion on sales of $2.4 billion.

An IPO is in the works, with a deal likely to happen in 2025.

Are IPOs a good investment?

IPOs can be a great way to invest in early-stage growth companies, and gains can potentially be massive.

Then again, the risks can be substantial. "Market history is littered with examples of 'hot' IPOs that have gone on to become market duds," said Ed Ciancarelli, senior portfolio manager at Focus Partners.

"Lyft, Inc (LYFT) went public at $72 on March of 2019 after pricing above the expected range of $62 to $68 per share," Ciancarelli notes. "LYFT closed the first day of trading at $78 and has not seen that level since. Such broken IPOs become the victim of an overly exuberant market and unattainable expectations."

An IPO should be considered a higher risk category for your portfolio. For example, it might be best to allocate no more than 5% to 10% in these types of investments.

Before investing in an IPO, you might want to wait until the excitement subsides.

"Be patient and wait for the stock price to have its inevitable dip prior to investing," suggests Jeff McClean, CEO at Solidarity Wealth. "Unless you are one of the lucky few who have access to pre-IPO stock at reasonable valuations, patience is the best course."

Moreover, it's a good idea to read the S-1, a regulatory filing that includes important information about the company that is planning to go public. Make sure to focus on the prospectus summary, risk factors and the letter from the founders.

Related content

Get Kiplinger Today newsletter — free

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Tom Taulli has been developing software since the 1980s when he was in high school. He sold his applications to a variety of publications. In college, he started his first company, which focused on the development of e-learning systems. He would go on to create other companies as well, including Hypermart.net that was sold to InfoSpace in 1996. Along the way, Tom has written columns for online publications such as Bloomberg, Forbes, Barron's and Kiplinger. He has also written a variety of books, including Artificial Intelligence Basics: A Non-Technical Introduction. He can be reached on Twitter at @ttaulli.

-

Stock Market Today: "Good Trump" Gives Dow 740-Point Boost

Stock Market Today: "Good Trump" Gives Dow 740-Point BoostFriday's headwind was Tuesday's tailwind, as President Trump's social media posts continue to drag and drive financial markets.

-

What Medicare Covers When You Travel in the US and Abroad

What Medicare Covers When You Travel in the US and AbroadMedical emergencies can happen at any time. Knowing what Medicare coverage you have, anywhere in the world, can help you avoid a massive bill.

-

Stock Market Today: "Good Trump" Gives Dow 740-Point Boost

Stock Market Today: "Good Trump" Gives Dow 740-Point BoostFriday's headwind was Tuesday's tailwind, as President Trump's social media posts continue to drag and drive financial markets.

-

Six Key Earnings Terms Every Investor Should Know

Six Key Earnings Terms Every Investor Should KnowThis handy guide will help you understand some of the jargon in corporate earnings reports and why it is important for investors to know.

-

What Is AI? Artificial Intelligence 101

What Is AI? Artificial Intelligence 101Artificial intelligence has sparked huge excitement among investors and businesses, but what exactly does the term mean?

-

Scam Alert: Bioelectronic Medicine Is Both Promising and Ripe for Fraud

Scam Alert: Bioelectronic Medicine Is Both Promising and Ripe for FraudMy reader needed help dealing with a scam that cost her $2,000 for vagus nerve stimulators, but legit VNS actually offers hope for the treatment of many diseases.

-

Advisers: Master the Fed Funds Rate, Help Clients Master Retirement

Advisers: Master the Fed Funds Rate, Help Clients Master RetirementUnderstanding the Federal Reserve's key tool can help financial professionals guide clients through economic shifts and opportunities.

-

2025 Kiplinger Readers' Choice Awards Results

2025 Kiplinger Readers' Choice Awards ResultsReaders' Choice Awards In our 2025 Readers' Choice Awards survey, readers evaluated brokers, wealth managers, banks and other financial providers. Find out which ones rose to the top.

-

Are Brighter Days Ahead for This Fidelity Health Care Fund?

Are Brighter Days Ahead for This Fidelity Health Care Fund?Health care stocks are showing signs of life after a lengthy period of underperformance. That bodes well for the Fidelity Select Health Care Portfolio.

-

Car Wash Investing: Cut Tax Grime and Polish Your Portfolio

Car Wash Investing: Cut Tax Grime and Polish Your PortfolioReal estate investing professional explains the tax advantages and efficiencies of investing in car wash real estate.